Every business faces the same fundamental challenge: balancing the costs of acquiring new customers with the value of keeping existing ones. Research shows that acquiring a new customer costs five to seven times more than retaining an existing one. Yet many companies continue investing heavily in acquisition whilst overlooking retention opportunities.

Understanding customer retention isn’t simply about preventing departures, it’s about building sustainable relationships that drive long-term profitability. Businesses that excel at retention gain a competitive edge by not only protecting short-term revenue, but also building a strong foundation for long-term growth and resilience.

What is Customer Retention?

Customer retention represents your business’s ability to keep customers engaged and purchasing over extended periods. Rather than focusing solely on one-off transactions, retention encompasses the ongoing relationship between your brand and customers, measuring how successfully you maintain their loyalty and encourage repeat business.

At its core, customer retention reflects customer satisfaction, value perception, and emotional connection with your brand. It’s not simply about preventing customers from leaving; it’s about creating compelling reasons for them to stay, grow their relationship with you, and potentially become advocates who bring others into your customer base.

Difference Between Customer Acquisition and Retention

Customer acquisition focuses on attracting new prospects and converting them into first-time buyers. This process involves marketing campaigns, lead generation, sales processes, and initial conversion activities. The timeline is typically short-term, with clear start and end points marking the journey from prospect to customer.

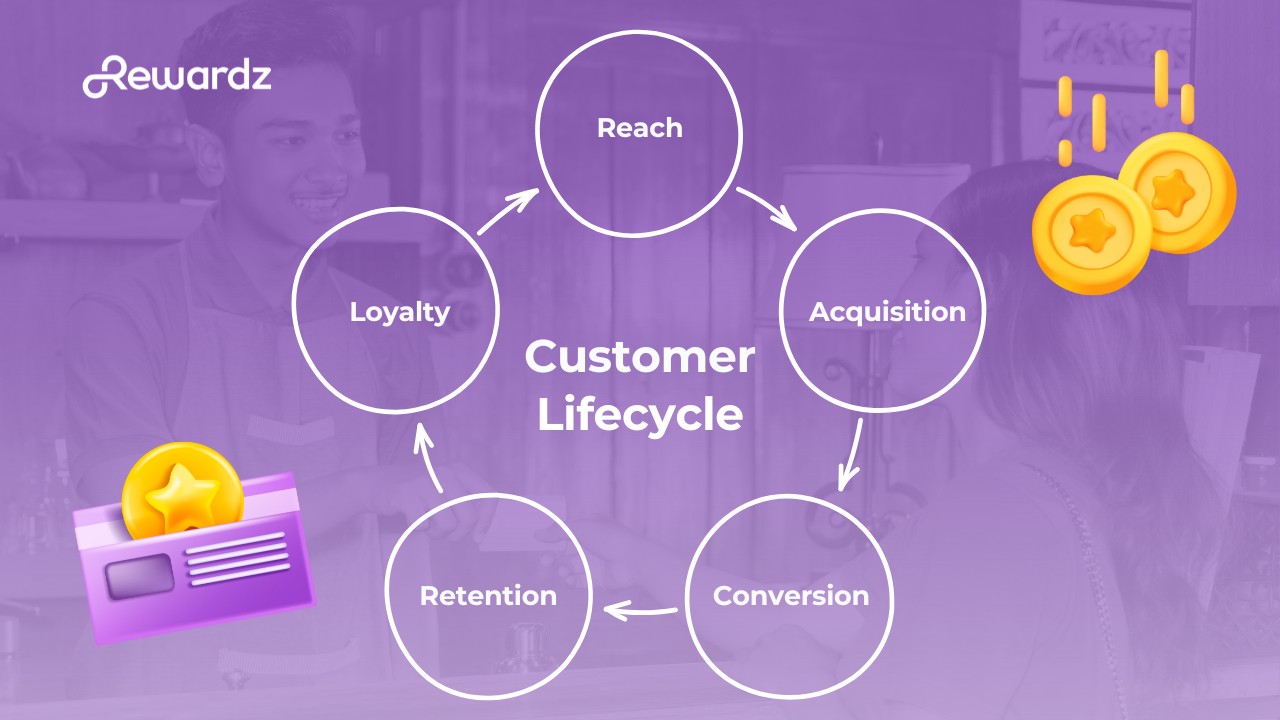

Retention, conversely, begins after acquisition and continues throughout the customer lifecycle. It’s an ongoing process requiring sustained effort, relationship building, and continuous value delivery. Where acquisition is often transactional, retention is relational, requiring deeper understanding of customer needs, preferences, and evolving expectations.

The resource allocation differs significantly between these approaches. Acquisition demands substantial upfront investment in marketing, advertising, and sales activities with uncertain outcomes. Retention leverages existing relationships, making investments more predictable and typically generating higher returns on investment.

Also read: Customer Engagement Strategies and Platforms That Drive Real Results

Why Retention Matters More Than Acquisition

The mathematics of retention versus acquisition strongly favours retention strategies. McKinsey found that existing customers purchase more frequently, spend more per transaction, and cost significantly less to serve than new customers. They’ve already overcome the initial trust barriers and understand your value proposition.

These financial benefits naturally translate into operational advantages, particularly through reduced marketing costs. Retained customers require less convincing and respond better to targeted communications because they already understand your value proposition. This efficiency extends to customer service operations, where retained customers understand your processes, products, and policies, leading to faster resolution times and higher satisfaction scores across all touchpoints.

Beyond operational improvements, retained customers provide strategic advantages through the valuable market intelligence they offer. Long-term customers become trusted advisors who provide insights into industry trends, competitive activities, and emerging needs that newer customers cannot offer. These customers often participate willingly in product development feedback, beta testing, and case studies that support future marketing efforts, creating a collaborative relationship that benefits both parties.

This collaborative relationship accelerates brand building as retained customers naturally become advocates, sharing positive experiences through word-of-mouth recommendations and online reviews. This organic promotion carries significantly more credibility than paid advertising and typically converts prospects at higher rates, creating a virtuous cycle of growth driven by customer satisfaction rather than marketing spend.

Perhaps most importantly, retained customers provide essential business stability during market fluctuations. When economic conditions tighten or competition intensifies, loyal customers are more likely to maintain their relationships, providing revenue continuity that supports strategic decision-making and long-term planning.

Measuring Customer Retention Success

Different industries measure retention differently. Subscription-based businesses might track monthly or annual renewal rates, whilst retail companies focus on repeat purchase frequency. Service providers may examine contract renewals and service expansion. Regardless of your sector, the principle remains consistent: successful retention means customers choose you repeatedly when alternatives exist. Here’s how to measure customer retention:

How to Measure and Calculate Customer Retention

Customer retention measurement requires establishing clear timeframes and consistent methodologies. The basic retention rate formula is:

[(Customers at End of Period – New Customers Acquired) / Customers at Start of Period] × 100

This calculation provides a percentage indicating how many existing customers remained active during the specified period.

Choosing appropriate measurement periods depends on your business model and customer behaviour patterns. The key is consistency in measurement timing and criteria for defining “active” customers.

Beyond basic calculations, more sophisticated analysis methods can provide deeper insights into retention patterns. Cohort analysis enhances retention measurement by tracking customer groups based on acquisition periods, allowing you to identify trends, seasonal patterns, and the effectiveness of specific campaigns or changes. This approach reveals whether retention rates are improving over time and which customer segments demonstrate strongest loyalty.

Building on cohort insights, customer segmentation adds another dimension to retention analysis, enabling you to examine retention rates across different customer types, purchase behaviours, or demographic characteristics. This granular view helps identify which segments require targeted retention efforts and which strategies prove most effective for specific groups.

Impactful Customer Retention Metrics

Measuring retention requires focusing on metrics that provide actionable insights rather than vanity numbers. The following five metrics offer the clearest picture of customer loyalty and retention health:

- Customer Lifetime Value (CLV) quantifies the total revenue expected from a customer throughout their relationship with your business, helping justify retention investments and prioritise high-value segments.

- Churn Rate measures the percentage of customers who stop purchasing within specific timeframes, identifying at-risk periods and enabling preventive measures before customers leave.

- Net Promoter Score (NPS) gauges customer satisfaction and loyalty by measuring willingness to recommend your business, with high scores typically correlating with strong retention rates.

- Repeat Purchase Rate indicates the percentage of customers making multiple purchases, revealing product satisfaction levels and customer engagement with your offerings.

- Customer Engagement Score tracks interaction frequency across touchpoints, helping predict retention likelihood and identify customers requiring immediate attention or intervention.

Common Reasons Customers Churn

Understanding why customers leave provides the foundation for building effective retention strategies. Whilst every business faces unique challenges, five primary reasons consistently drive customer departures across industries:

- Product or Service Dissatisfaction occurs when offerings fail to meet expectations or solve promised problems. Quality issues, missing features, or performance problems create frustration that ultimately leads to customer departure.

- Poor Customer Service Experiences drive significant churn when customers feel undervalued, encounter unhelpful staff, or face lengthy resolution times. Responsive, empathetic support is essential for maintaining customer relationships.

- Pricing and Value Perception Issues arise when customers believe they’re not receiving adequate value for their investment. This often indicates insufficient communication about value delivered rather than genuinely high prices.

- Competitive Alternatives attract customers when competitors offer superior products, better prices, or more attractive terms. Market evolution constantly creates new options that challenge customer loyalty.

- Onboarding Failures create early churn when new customers struggle to realise value quickly. Complex setup processes, inadequate training, or unclear expectations lead to abandonment before relationships properly develop.

10 Strategies for Improving Customer Retention

Effective customer retention requires moving beyond reactive damage control to proactive relationship building. The most successful businesses implement systematic approaches that address different stages of the customer journey. These ten effective strategies provide a comprehensive framework for strengthening customer relationships.

- Optimise Onboarding Processes First impressions matter enormously in customer retention. Streamline your onboarding to help customers achieve their first success quickly. Create step-by-step guides, provide proactive support, and set clear expectations about timelines and outcomes. Track onboarding completion rates and identify common drop-off points for continuous improvement.

- Implement Proactive Customer Success Programmes Don’t wait for customers to encounter problems. Monitor usage patterns, identify potential issues early, and reach out with solutions before customers become frustrated. Assign dedicated success managers to high-value accounts and create automated alerts for concerning behaviour patterns.

- Develop Personalised Communication Strategies Generic communications feel impersonal and often get ignored. Segment customers based on behaviour, preferences, and history to deliver relevant, timely messages. Use customer data to personalise content, timing, and channel selection for maximum engagement.

- Create Exceptional Customer Service Experiences Transform customer service from cost centre to retention driver. Train staff to exceed expectations, empower them to resolve issues without escalation, and follow up to ensure satisfaction. Consider implementing live chat, comprehensive FAQs, and multiple contact options.

- Build Loyalty and Rewards Programmes Recognition and rewards reinforce positive behaviour and create emotional connections with your brand. Design programmes that offer meaningful benefits aligned with customer preferences, not just discounts. Consider experiential rewards, exclusive access, and personalised recognition. Modern loyalty programmes succeed through flexibility and global reach, allowing customers to choose rewards that genuinely appeal to their interests and circumstances. Platforms like SPUR enable businesses to offer comprehensive digital gift card solutions from over 2,000 partners across 30+ countries, ensuring every customer finds meaningful rewards. This approach transforms traditional loyalty programmes into personalised recognition systems that strengthen customer relationships and drive long-term retention.

- Gather and Act on Customer Feedback Regular feedback collection demonstrates that you value customer opinions. More importantly, acting on feedback shows customers their voices matter. Implement systematic feedback collection through surveys, interviews, and usage analytics, then communicate changes made based on input received.

- Provide Ongoing Value and Education Help customers maximise their investment in your products or services through educational content, training sessions, and best practice sharing. Regular value delivery keeps your brand top-of-mind and strengthens the relationship beyond transactional interactions.

- Use Data-Driven Retention Campaigns Leverage customer data to predict churn risk and trigger targeted interventions. Identify patterns that precede customer departure and create automated campaigns to address these situations. Test different approaches and refine based on results.

- Foster Community and Engagement Create opportunities for customers to connect with each other and your brand beyond purchase transactions. This might include user groups, online forums, events, or social media communities. Strong communities create switching costs and peer support networks.

- Implement Win-Back Campaigns Not all customer departures are permanent. Design campaigns to re-engage lapsed customers with special offers, product updates, or personalised outreach. Analyse why customers left and address those specific concerns in your win-back messaging.

Also read: 25 Impactful Loyalty Program Examples You Can Learn From

5 Real-World Customer Retention Examples

Learning from successful retention strategies requires examining how industry leaders translate theory into practice. These five companies demonstrate different approaches to customer retention, each offering unique insights that can be adapted across various business models and industries.

- NTUC FairPrice Omnichannel Integration

NTUC FairPrice successfully integrated both physical and digital platforms to create a seamless customer journey that includes click-and-collect services and shared loyalty points across online and in-store experiences. This comprehensive “online-offline” approach keeps customers engaged regardless of their preferred shopping channel, addressing the critical need for flexibility in Singapore’s highly digital customer landscape whilst maintaining consistent brand experience across all touchpoints.

- Watsons Digital Gamification

Watsons transformed traditional loyalty stamps into an innovative digital collector game within their mobile application, moving beyond conventional reward systems to create an interactive customer experience. This gamified approach sparked significant customer interest, drove consistent repeat visits, and boosted overall sales performance, demonstrating how effective digitalisation and gamification strategies can substantially increase customer retention in competitive retail environments.

- Grab Community-Centric Approach

Grab strengthens customer retention through comprehensive ambassador campaigns, community-driven initiatives, and engaging user events including contests and influencer-hosted gatherings that extend beyond traditional transactional relationships. This community-focussed strategy builds a strong sense of belonging and emotional connection with the brand, creating loyalty that transcends typical service provider relationships and establishes Grab as an integral part of customers’ daily lives and social experiences.

- DBS Wealth Continuum Strategy

DBS leverages a sophisticated “wealth continuum” strategy to retain private banking clients by offering personalised wealth management services, exclusive high-value events, and advanced digital tools that systematically deepen client engagement over time. Their retention approach focuses on strategically progressing client relationships through holistic financial solutions that evolve with customer needs, creating long-term partnerships rather than simple service provision arrangements.

- Singapore Airlines Ecosystem Expansion

Singapore Airlines extends customer engagement beyond traditional flight bookings through their KrisFlyer programme, which incorporates gamified features like KrisFlyer Spree to create multiple touchpoints with customers throughout their travel journey. This comprehensive ecosystem approach boosts customer retention and increases ancillary spending through interactive elements that transform the travel experience into a holistic rewards ecosystem, encouraging customers to engage with the airline across various services and platforms.

These examples demonstrate that successful retention requires understanding what customers value most and delivering experiences that exceed expectations consistently. Each company identified unique value propositions aligned with customer priorities and built systematic approaches to deliver that value reliably.

Leverage Flexible Rewards Programme to Retain Customers

The most effective retention strategies often centre around recognition and rewards that resonate with diverse customer preferences. Traditional one-size-fits-all programmes increasingly fall short in today’s personalised landscape, where customers expect recognition that matches their individual interests and behaviours. Modern flexible rewards programmes address this challenge by offering choice and personalisation at scale.

We at Rewardz understand these evolving expectations and have developed SPUR, a comprehensive digital rewards platform designed to enhance customer retention through flexibility and global reach. Our solution provides access to digital gift card solutions from over 2,000 partners across 30+ countries, ensuring your customers find rewards that genuinely appeal to them.

The technical sophistication of modern rewards programmes matters as much as reward variety. SPUR integrates seamlessly with existing platforms through our APIs, allowing you to embed powerful retention tools without disrupting current operations. This integration capability means you can enhance customer experiences whilst maintaining operational efficiency.

Ready to transform your customer retention strategy with us? Book a demonstration to discover how SPUR can help you build stronger, more profitable customer relationships through meaningful recognition and rewards.